Update on Health of State Budgets

Entering the last months of 2014, the viewpoint for state budgets is steady. Revenue looks positive and expenditures are mostly in check. By and large, most state authorities envision a gradual change in state funds through the rest of the financial year says a report issued by the National Conference of State Legislature.

There are a few exemptions to this general standpoint, in any case, a small number of states report moderate to solid monetary conditions that are bringing about budget surplus projections. Alternately, a couple of states find themselves at the flip side of the financial range, and reported budget troubles.

Indeed with the general positive evaluation of state budget conditions, legislators keep on facing various budget issues. Authorities are worried about slow income growth, building back up reserves and spending patterns particularly for K-12 education and health services.

Revenue Outlook for the Remainder of FY 2014

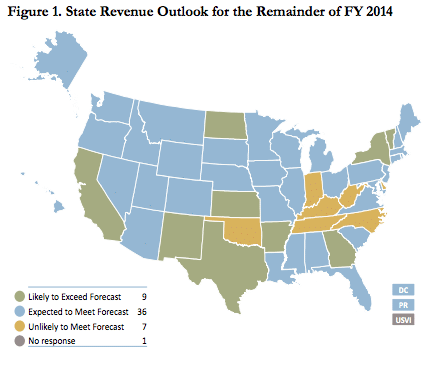

Most state authorities anticipate that revenue will meet, and in some cases surpass, FY 2014 projections.

This report is focused around information gathered in the spring of 2014 from administrative financial officers in each of the 50 states, the District of Columbia and Puerto Rico.

In a few states, revenues are expected to meet higher figures. In Illinois, for instance, revenues are anticipated to meet a figure that has increased by $627 million since the budget was put into action. On the other side, authorities in Maryland hope to meet a figure that was brought down by $126.7 million.

Revenues are liable to surpass projections in nine states. In California, accumulations were surpassing projections by $965 million (1.6 percent). Lawmakers are considering extra financing for K-12 and community colleges and expanding budget reserve. In Arkansas, revenues were $34.9 million higher than estimate and are an element in the state’s assessed FY 2014 surplus of $95 million. In Kansas, higher than expected revenues will be utilized for K-12 education in reaction to a state supreme court ruling, which discovered the state’s financing of schools to be illegal.

Revenues are lower than estimated in seven states. Delaware, Oklahoma and Tennessee will likely miss revenue targets essential on account of lower corporate pay charge accumulations. In West Virginia, collections of personal income and sales tax fell below projections, which was the main reason revenues are $78 million short. In North Carolina, tax changes, not financial conditions, are the reason that projections are likely to miss the target.